The crypto community is such that it is not just broad but also very advanced. Since the development of bitcoin, several other advancements have taken place in the crypto community. Yes, bitcoin is indeed the bedrock for cryptocurrencies, and another coin could be traced back to it. Nonetheless, it doesn’t mean other cryptos must have the same usage and characteristics as bitcoin. However, cryptocurrencies have several similarities, and one of them is that they all make use of blockchain technology.

Note that cryptocurrencies can be divided into several groups based on similarities and differences. Some could be classified based on their usage and while others with respect to their price. This content, however, doesn’t apply to those new to the crypto community as some technical terms will be used, so it’s primarily for those conversant with the crypto community.

Yes, some individuals still don’t know anything about cryptocurrency, some haven’t even heard of it, yet we are in the 21st century. Before explaining transaction validation for non-mined cryptocurrencies, we need to understand a few basic concepts.

What is the importance of non-mined crypto?

By now, you should understand that the non-mined and the mined cryptocurrencies, however different, they have a common goal and that is geared towards validation. Any transaction carried out on any network needs to be validated and verified to ensure the transaction was successful and avoid repetition.

So, in a nutshell, validation is the process of ascertaining a transaction that occurred successfully. A block is a group of transactions, and when these blocks of transactions have been validated, it’s added to the chains of previously validated transactions to form a chain of completed transactions which is known as the “blockchain.”

What is mining?

Mining is the process where an individual, a business enterprise, or group of individuals makes use of mathematical equations on a high-powered computer in a bid to verify or validate a block of transaction. Note that the process of using mathematical equations in mining is to keep out cybercriminals and third parties from gaining access to sender and receiver information.

The block reward is given to the first individual, business enterprise, or group of individuals to solve these equations and verify/validate the block of transaction. There are few validation consequences, such as the PoS and PoW. In the PoW (Proof-of-work) consensus, the block rewards are paid out in the validated cryptocurrency.

So, per adventure you provide validation on the bitcoin network, proofing the transaction’s success and marking it as “true,” you will be paid in bitcoin as a reward. If it’s on the Ethereum network, you’d be paid in ether tokens as the reward. So, you might be wondering how miners make their money; they make it by either cashing out the after investing the token or immediately converting the token to fiat.

How does the process of transaction validation work for non-mined cryptocurrencies?

There are several cryptocurrencies that cannot be mined, and some of them are Ripple, EOS, NEO, Stellar, and Cardano, to mention a few.

These non-mined cryptocurrencies run on the PoS (Proof-of-stake). The reason for this is because there are no competitors or high-powered computers in the native sense with the capacity to monitor the first validator of each block of the transaction, meaning the cost of this consensus is much lower compared to the Proof-of-work.

This phenomenon could explain why Cardano price is what it is currently and its transaction charges being pocket-friendly. Instead, your ownership in a cryptocurrency or your stake is the only ticket that qualifies you to be able to validate transactions.

So, the more cryptocurrency you possess, and the longer you’ve possessed this coin, the higher your chances of being chosen to validate a block of transaction.

However, some in-built fail-safes prevent the whales (more prominent stakeholders) from taking over the whole validation process. So, several randomized ways that these stakeholders can adopt in order to be chosen to validate transactions give room for smaller stakeholders also to have a chance. Also, the PoS (proof-of-stake) provides rewards for those who validate transactions differently.

So, instead of being rewarded in newly mined tokens, or a fragment of the tokens, the stakeholders receive the aggregate fees from a block of transactions. Note, however, that these fees may not equal the same block reward, but also note that the costs of these validation methods are lower.

Note that both the mined and non-mined cryptocurrencies are great, and as mentioned earlier, they both have their advantages and disadvantages. Both have one common end, and that is validation. Nonetheless, there’s an x-factor that hasn’t been discussed, and that’s the concept of supply limit for some cryptocurrencies like bitcoin that have stipulated supply limits.

So, at such a moment, it would be great for mined crypto to become non-mined using the proof-of-stake methods. Since the proof-of-stake reduces consumption and electricity cost and takes away computing network issues regarding proof-of-work, a slow but steady transition towards the non-mined cryptocurrency is imminent.

Although there are several factors put into the price of a cryptocurrency, Cardano’s price, for example, is not only a result of its adoption but also factors such as its supply limit, circulating supply, and others.

Wrapping up

With several cryptocurrencies being deployed in the crypto community, it won’t be long before the major transition from fiat money into digital assets becomes revolutionized. Have it that both the mined and non-mined cryptocurrencies are of the same source and run on blockchain technology.

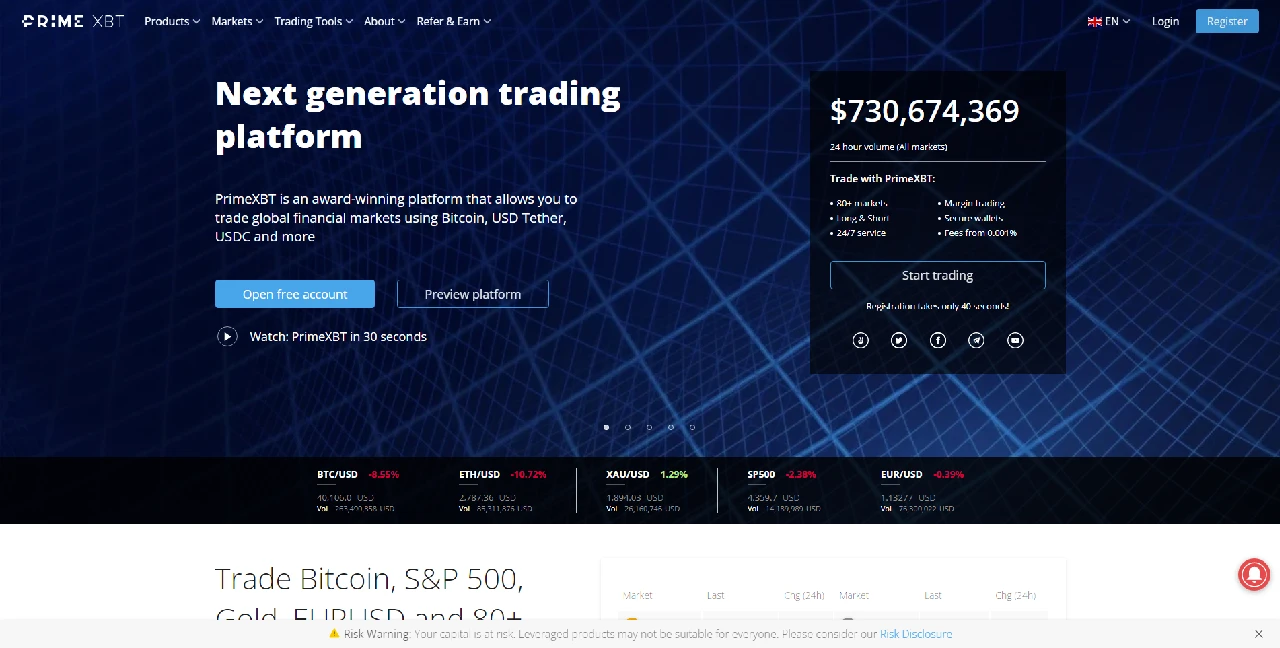

However, cryptos are now more than “money” but also a means of taking over the whole financial sector of every economy. Whether the currency can be mined or not, it can always be found on exchange platforms where buying and selling occur on a larger scale.

Instead of waiting for validation rewards which might take time with the PoS, it would be advisable you invest a handful of resources and stake as much crypto as possible. It would be worth it in the long run as the crypto community is growing rapidly.